Services that give you a complete picture.

Financial planning for life

Time is Money. But finding time to design your own financial success is often illusive.

By understanding your needs, we’ll establish clear and practical strategies, assess the risks, to design a plan for you and your family. Not just for today but geared to your continued professional success, optimising your plan, protecting your interests and assets whilst building a tax effective future retirement.

Working closely together, we bring together expertise across all key life & financial areas. Setting a path for all of your future personal and work life stages:

- Home & Investment Loans, Financial investments, Life related Insurance, Financial Coaching, Taxation, Estate Planning, Accountancy, Superannuation planning.

Investment portfolios

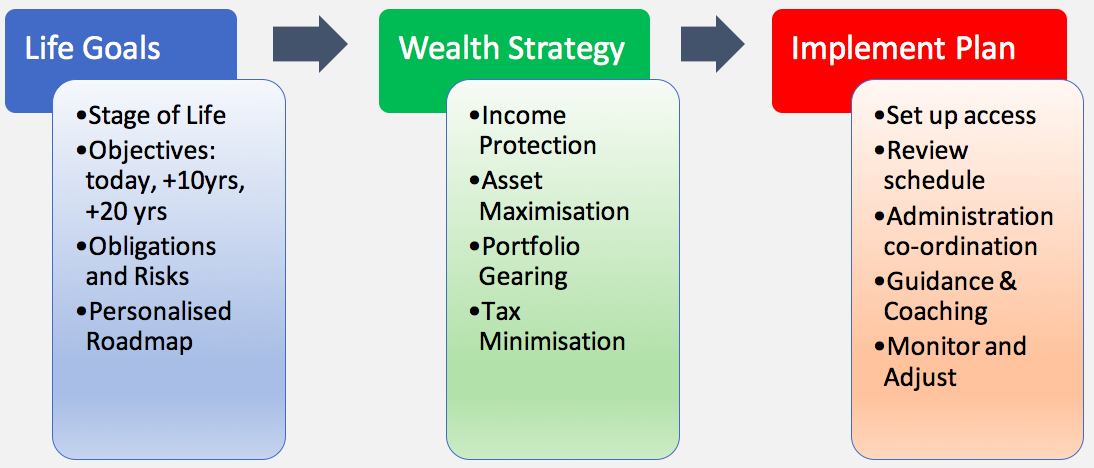

First, we’ll examine your life goals and align them with a suite of strategies that cover personal protection, asset usage and investment strategies.

This is your ‘Wealth Creation’ strategy and with it a personalised plan to achieve your objectives today and into the future.

Great investment strategies know how to access who is out-performing the market, then make timely decisions to take advantage of changing market conditions. Because the right wealth creation strategies should work hard without being hard work (for you).

Life, income & trauma insurance

No-one likes paying for insurance, but being properly protected is critical if the worst happens. The right plan ensures you and your loved ones don't suffer financial burdens and hardship. Our substantial leverage with Strategic partners such as MLC & BT, means that if something does happen, you're taken care of, when other insurers might hesitate.

And for those you love, we protect them too.

Importantly, your policies are reviewed annually and adjusted for your life stages (eg. young children versus grown-up adults) to make sure your #1 investments, you & your family, are fully protected.

Family financial coaching & literacy

Just because you’re an expert in your field, it doesn’t mean you’re expert in every field. The same goes for your family and financial literacy. We work with clients and their families because we want to educate all of them to make the right ‘wealth’ decisions; especially the children. Most 20-24 year olds have more money in Superannuation than their own Bank account.

We’ll work through what they want to know, what it means and how better decisions are made. Knowing your goals too, helps them support and prosper from your hard work.

Home & investment property loans

We don’t think Property Loans are all the same. As a strategic partner to Westpac, our clients receive unparalleled professional rates that recognise your standing in the community. Loans are structured to manage your debt position whilst keeping future options open.

In-house access to loan expertise & processing means no delay to switching loans and integrating them into your household budget.

Our ‘Property Outlook’ too gives you the same access as Real Estate Agents on sales and rental data, ensuring you have a complete ‘property picture’.

superannuation, retirement & estate planning

The key to Self Managed Super Funds (SMSF) is the ability to build wealth whilst minimising the tax implication of your investments. We structure your SMSF utilising our extensive knowledge of tax & accounting law; personal, company & trust structures.

We also offer retail superannuation accounts for clients that want to access specialist fund managers without setting up a SMSF.

With at least 45% of Australians not having a valid will, it’s critical to incorporate Wills, Estate Planning and Inheritance strategies into your financial plan. Our extensive experience and professional alliances mean your current financial plan integrates a future no matter how far away it may seem.